Reverse home loans were created for older people to tap their house equity to increase their month-to-month cash circulation without the problem of monthly payments. To receive a reverse home loan, you need to be at least 62 years old. Potential borrowers also need to go through a home counseling session to guarantee that they fully understand the ins and outs of a reverse home mortgage.

Financial investment homes and villa don't certify. You need to live at the property for more than 6 months of the year. Generally, you can't obtain more than 80% of your home's worth, up to the FHA maximum of $726,525 for 2019. Normally, the older you are, the more you can borrow.

" So, they are taking a look at getting a loan that's worth 68% of their house's worth." You're also needed to pay real estate tax, property owner's insurance coverage and mortgage insurance coverage premium in addition to maintaining the home. Your lending institution will assess whether you have enough non reusable income to satisfy these obligations. In some cases, lenders might require that some of the equity from the reverse home mortgage is reserved to pay those expenses going forward.

That indicates the loan balance grows over time. For circumstances, you may borrow $100,000 upfront, however by the time you die or offer your house and move, you will owe more than that, depending on the rates of interest on the reverse mortgage. There are 5 methods to have the funds from a reverse home mortgage dispersed to you: You can take the cash you're entitled to upfront.

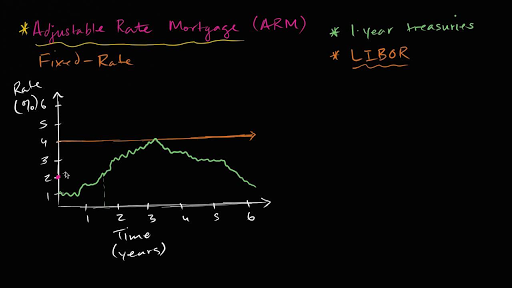

Typically, these types of reverse home loans come with a fixed interest rate on the impressive balance. You can get the funds as a month-to-month payment that lasts as long as you stay in your house. This reverse home loan usually has an adjustable rate of interest. You can receive funds month-to-month for a specific period.

The rates of interest is also adjustable. Under this circumstance, you do not take any cash at all. Instead, you have a line of credit you can draw on at any time. The credit line also grows with time based on its adjustable interest http://kameronanbb080.iamarrows.com/excitement-about-reverse-mortgages-and-how-they-work rate. You can also combine the above alternatives.

The Definitive Guide for How Do Second Mortgages Work

If you wish to alter the choices later on, you can do this is by paying an administrative fee, Stearns said. If you wish to stay in your home for a very long time in your retirement and have no desire to pass down your house to your children, then a reverse mortgage may work for you.

The perfect reverse mortgage debtors also are those who have developed substantial and varied retirement cost savings. "But they have substantial wealth in their house and they want as much spendable funds in their retirement as possible," said Jack Guttentag, professor of finance emeritus at the Wharton School of the University of Pennsylvania.

If you do not completely comprehend the home loan, you should also prevent it. "These are intricate products," Nelson stated. "It's a mind tornado to believe about equity going away." If you wish to leave your home to your children after you pass away or move out of the home, a reverse home loan isn't a great option for you either.

If you don't make your property tax and insurance coverage payments, that could trigger a foreclosure. Similarly, if you don't respond to annual correspondence from your loan provider, that could likewise trigger foreclosure procedures. Unfortunately, minor violations like not returning a residency postcard, missing out on tax or home insurance payment, or bad servicing can cause foreclosure rapidly.

If your partner is not a co-borrower on the reverse mortgage when you pass away, what takes place next depends upon when the reverse home loan was taken out. If it was secured on Extra resources or after Aug. 4, 2014, a non-borrowing spouse can remain in the house after the debtor passes away but does not get any more of the loan funds as long as he or she meets these eligibility requirements: Married to the borrower when the loan closed Remain wed up until the borrower dies Named as a non-borrowing partner in the loan files Live and continue to reside in the home as the primary house Able to show legal ownership after the debtor dies Pay the taxes and insurance coverage and keep the house's upkeepThe customer and spouse need to accredit at the loan's closing and every following year that they are still wed and the spouse is a qualified non-borrowing spouse.

If these conditions aren't fulfilled, the partner can face foreclosure. For reverse mortgages secured before Aug. 4, 2014, non-borrowing spouses have less protections. The loan provider does not have to allow the non-borrowing partner to remain in the house after the debtor passes away. A borrower and his or her spouse can ask a loan provider to apply to HUD to permit the non-borrowing partner to remain in your home - how do second mortgages work in ontario.

The Basic Principles Of How Adjustable Rate Mortgages Work

Some lending institutions offer HECM lookalikes but with loan limits that surpass the FHA limit. These reverse home mortgages often resemble HECMs. how do reverse mortgages work in california. However it is necessary to comprehend any differences. Know how your reverse mortgage professional makes money. If paid on commission, be careful if the expert encourages you to take the maximum in advance cash, which means a larger commission.

" People do not take a look at reverse home loans till it becomes a need. They can be desperate." There are other methods for seniors to open the equity they constructed up in their homes over the decades without taking out a reverse home loan. If you require the equity for your retirement years, it's key to think about all choices.

The downside is quiting the family house. However potential upsides include moving closer to family and purchasing a home better for aging in place. You can either refinance or secure a new home mortgage if you don't have an existing one and squander some of the equity.

You could likewise borrow versus your house equity using a house equity loan or credit line. A loan permits you to take a swelling sum upfront that you pay back in installment payments. With a line of credit, you can borrow from it at any time, as much as the maximum quantity.

A reverse mortgage, like a conventional home loan, permits house owners to borrow money using their home as security for the loan. Also like a conventional mortgage, job selling timeshares when you take out a reverse home mortgage loan, the title to your house stays in your name. However, unlike a traditional home mortgage, with a reverse home loan, customers do not make month-to-month mortgage payments.

Interest and costs are included to the loan balance every month and the balance grows. With a reverse home mortgage loan, house owners are required to pay real estate tax and homeowners insurance coverage, utilize the property as their principal residence, and keep their home in good condition. With a reverse mortgage loan, the amount the homeowner owes to the loan provider goes upnot downover time.

An Unbiased View of How Mortgages Work Selling

As your loan balance increases, your house equity reduces. A reverse mortgage is not totally free money. It is a loan where obtained money + interest + costs each month = increasing loan balance. The house owners or their beneficiaries will eventually have to pay back the loan, usually by selling the house.